Long Strangle Options Strategy: Beginner's Guide

The long strangle is a risk-defined options strategy built to profit from large price swings and increased implied volatility. It is low-probability, high-risk, and tends to lose money over the long run.

The long strangle options strategy consists of buying both an out of the money call and put on the same underlying asset, approximately equal distance away from the current market price. Both options must be in the same expiration cycle and have the same contract size.

Highlights

- Risk: Limited to the premium paid, but high overall. You need a big move just to breakeven.

- Reward: Unlimited on the upside, substantial on the downside.

- Outlook: Volatile. I only put this trade on when implied volatility is extraordinary low and I expect a big, sustained move.

- Edge: Comes from timing. If IV spikes or the underlying runs, this trade can become profitable.

- Time Decay: Theta chips away at both sides every day the stock does nothing.

- Profitability: Generally below 50%.

- Vs. Long Straddle: Cheaper to enter but needs a larger move to overcome the debit and turn a profit.

🤔 New to options? It helps immensely to understand both the long put and long call strategies before jumping into strangles.

Long Strangle: Trade Components

Here are the basic trade components of a long strangle:

- Buy 1 OTM put option

- Buy 1 OTM call option

- Both options are the same distance from the stock price

- Both have the same expiration date

Ideally, you set up the trade in one order, a "long strangle." If you leg in, you’ll be exposed to directional risk.

You can see the trade setup below on the TradingBlock dashboard:

Market Outlook: When to Buy a Strangle

Here are a few scenarios where it may make sense to buy a strangle:

- Implied volatility is extremely low: The market is always in flux. Buy low, sell high. That applies to IV, too. When buying options, you want to get in when IV is low and exit when IV rises.

- Expecting a major event: If you anticipate both a significant, sustained move and a rise in IV, a strangle can make sense. You will likely need both of these working together to turn a profit. Examples of popular entry times include before earnings or major economic data.

- Around a 1-month time horizon: Buying strangles about a month out gives you time before time decay really starts to pick up. Aim to exit a week before option expiration.

Long Strangle Payoff Profile

And now let’s break down the maximum loss, breakeven points, and profit potential for this trade.

Maximum Profit Zone

The long strangle makes money when the stock moves big in either direction. You’re long a call and a put, both out of the money, so you need movement.

For example, let’s say you pay $5 total for a strangle on ABC, a high-beta stock trading at 100:

- Buy 105 call for 2.50

- Buy 95 put for 2.50

- Total debit (max loss) is 5.00

You need the stock to move outside the strike prices by more than what you paid to start turning a profit.

Breakeven Zone

A long strangle has two breakeven points — one above the call strike, one below the put strike. Here’s how to calculate them:

- Upper breakeven is the call strike plus the total premium paid

- Lower breakeven is the put strike minus the total premium paid

In our example, we paid 5.00 for the 105 call and 95 put on ABC. That gives us breakevens of:

- Upper breakeven is 105 plus 5, which equals 110

- Lower breakeven is 95 minus 5, which equals 90

We can see these breakeven zones below:

Maximum Loss Zone

Whenever you are in a net debit trade like this one, the most you can lose is the option premium paid.

- Max loss = total premium paid

Realizing max loss on a long strangle is pretty common. Since both options are usually quite a bit out of the money, they have a low likelihood of expiring in the money. Returning to our earlier example:

- Buy 105 call for 2.50

- Buy 95 put for 2.50

- Total debit (max loss) is 5.00

If ABC closes anywhere between 95 and 105 at expiration, both options expire worthless. The entire $500 is lost. This is the max loss on the trade.

Margin Requirements

The debit paid is the margin required for a long strangle because this is the most we can lose on the trade. For example, if the net debit of our trade is $3, our total trade cost is $300.

But just because our max loss is capped up front doesn't make the trade less dangerous. Always consider how much movement (or volatility) you realistically expect before placing this trade.

Long Strangle: Moneyness and Skew

Most long strangles are bought with the call and put option equal distance away from the stock price. You can, however, buy strangles with a bullish or bearish leaning.

.png)

For example, if ABC is trading at $100 and you think it’s headed higher, you might buy the 97 put and the 107 call. It’s still a long strangle, but both strikes are shifted higher, so it has a bullish tilt.

This is called “skewing the strangle.” You adjust the strikes in the direction you expect the stock to move. The trade remains long premium, but your breakevens shift accordingly.

Examples: Stock trading at $100

- Bullish skew: Buy the 97 put and 107 call

- Bearish skew: Buy the 93 put and 103 call

Long Strangle: IBIT Trade Example

In this trade example, we expect a breakout in IBIT (iShares Bitcoin Trust) but are unsure in which direction. Implied volatility is currently very low, so the long strangle is the perfect trade for us.

Our timeframe is five weeks. As we’ve said before, it’s usually best to exit a long strangle at least a week before expiration, but we will run this one until expiration for educational purposes.

We will be looking to buy both a call and put option 5% out of the money. Let’s jump over to the TradingBlock dashboard and find strike prices and an expiration cycle that give us enough time to catch the move.

IBIT Trade Setup

I’ve never placed a market order in over twenty years of trading options. I always use a limit order, starting at the midpoint between the bid and ask.

If you don’t get filled immediately (and want to), walk your order up in penny or nickel increments until you do. And if you can’t get a decent fill, skip the trade. You can learn more about options trading liquidity metrics here.

We’ll assume we got filled at the midpoint here:

IBIT Trade Details

And here are the details of the trade we just put on:

- IBIT Price: 62.60

- Expiration: 44 days

- Buy 65.5 Call @ $2.88

- Buy 59.5 Put @ $2.31

- Net Debit Paid: $5.19 ($519 total)

- Breakeven Prices:

- Lower: 59.5 – 5.19 = $54.31

- Upper: 65.5 + 5.19 = $70.69

- Max Loss: $5.19 ($519 total)

- Max Profit: Unlimited

- No Margin Requirement (just premium paid)

The most we can lose here is the $5.19 ($519) we paid in premium. We need IBIT to move outside of $54.31 or $70.69 to turn a profit. The further it moves, the more we may make.

Let’s explore a few trade outcomes!

IBIT: Winning Trade Outcome

In this outcome, IBIT soared through the roof on inflation jitters. Here’s how the trade played out:

- IBIT Price: $62.60 → $78.00 ⬆️

- Expiration: 44 days → 0

- Long 65.5 Call @ $2.88 → $12.50

- Long 59.5 Put @ $2.31 → $0.00

- Final Value: $12.50 on the call

- Net Gain: $12.50 – $5.19 = $7.31 ($731 total)

- Percent Return: 141% profit

And here is how our options traded:

This trade was a big win for us. IBIT closed at $78 on expiration, leaving our long call option with $12.50 in intrinsic value. Intrinsic value is simply how much an option is in the money by. Extrinsic value, which accounts for IV and time, is gone from the trade on expiration.

We can see that our put began tanking around 20 DTE as IBIT rallied, ultimately expiring worthless.

We haven’t accounted for the emotional factor of holding long strangles and waiting for the move to happen. About two weeks into our trade, our long strangle was trading for $3.50, or roughly 30% below what we paid. You have to have guts to hold these trades over time.

IBIT: Losing Trade Outcome

In this outcome, IBIT barely moved, closing between our strike prices and resulting in a maximum loss as range-bound chop slowly ate away at our premiums. Here’s where we ended:

- IBIT Price: $62.60 → $62.00 ⬇️

- Expiration: 44 days → 0

- Long 65.5 Call @ $2.88 → $0.00

- Long 59.5 Put @ $2.31 → $0.00

- Final Value: $0.00

- Net Loss: $5.19 – $0.00 = $5.19 ($519 total)

- Percent of Premium Lost: 100%

And here is how our trade played out over time:

.png)

As I mentioned, it's wise to close these trades once you reach 50% over the premium you paid. Our strangle was trading at this level, just under $8, with 23 days to go until expiration. That means we still had more than 50% of the trade’s time left, and we had already hit this level.

But we didn’t close the trade, and time decay slowly chipped away at the value of our options, ultimately causing them both to expire worthless.

We just examined the broad strokes of long strangles. Next, we will explore time decay, implied volatility, and delta.

Choosing Your Deltas

In options trading, delta tells you two things:

- How much the option moves for every $1 move in the stock

- The probability the option expires in the money

We're focused on the second one here. When I put on a long strangle, I look for deltas in the 0.20 to 0.30 range.

Since we’re buying both a call and a put, think in terms of combined probability. If I buy options with 0.25 delta on each side, the market’s saying there's about a 50% chance the stock finishes outside one of the strikes, meaning one leg lands in the money.

But remember, you must also account for the premium you paid. Just because one of your options expires in the money doesn’t necessarily mean you have a winner—you have to make more than what you spent on the trade to turn a profit.

Strangles and Time Decay (Theta)

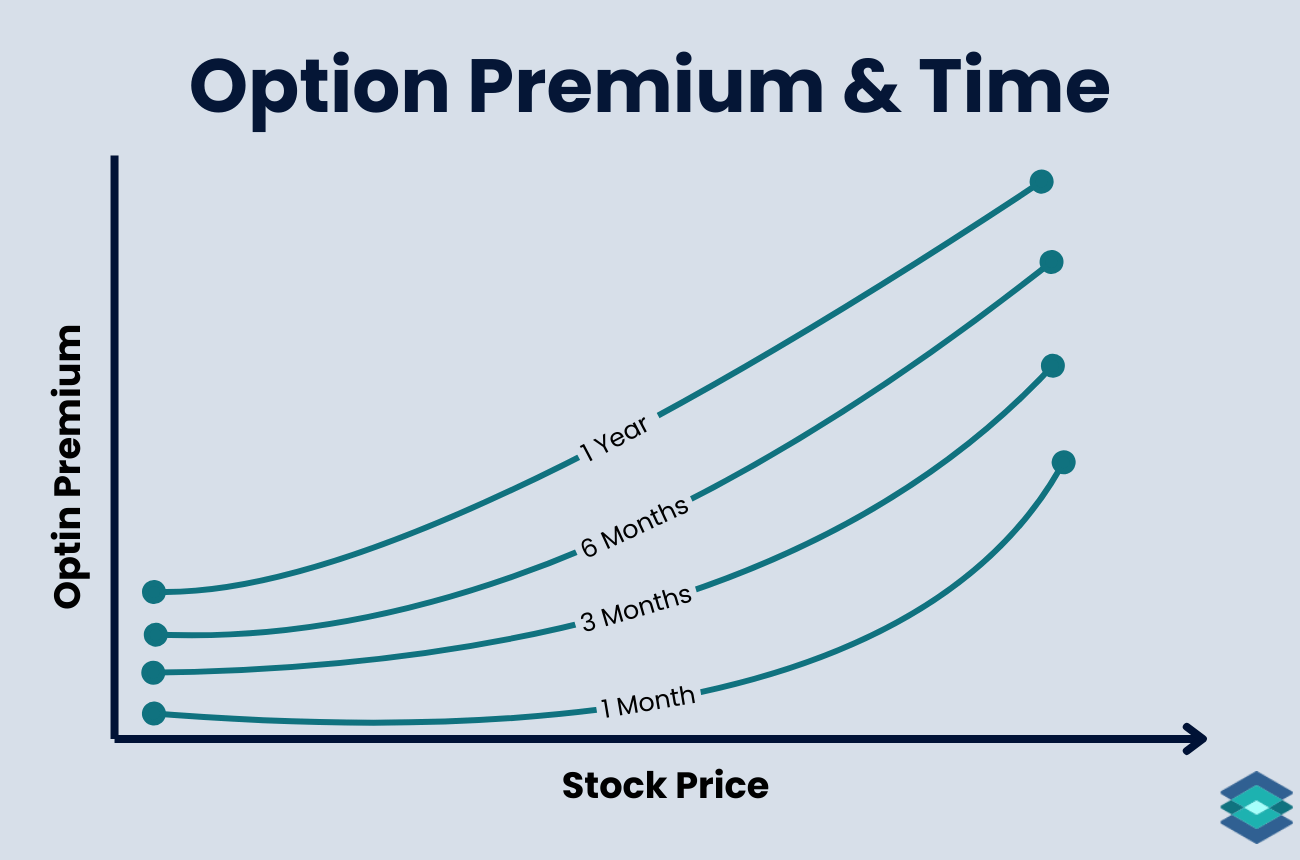

By far and wide, professional traders prefer selling options over buying them. This is because, in a constant environment, options perpetually shed value. And the closer expiration gets, the faster that decay picks up. We can see this below:

.png)

So, do we want to buy options before they enter the red zone (~45 days)?

Not necessarily. While it’s true that time decay picks up the closer you get to expiration, buying options earlier just means paying more in extrinsic value (comprised of time and implied volatility).

Personally, I like buying options within the 30-45-day expiration window, and I almost always close before expiration, ideally at least one week before.

Don’t forget you want time to adjust or manage the trade if things don’t go your way. If you buy a strangle with 2 DTE and the stock doesn’t move after day one, there will not be much premium left to work with to readjust. Buying options on 0DTE is more akin to gambling than trading.

Long Strangles and Implied Volatility

Since we’re net long options, implied volatility is our best friend. Even if the stock goes nowhere, a long strangle can still be profitable if IV spikes.

Here are a few things to know about implied volatility and vega, the Greek that measures how much an option’s price moves when IV changes:

- IV has a bigger impact on longer-dated options

- Short-term options are more sensitive to price movement (gamma), not IV

- IV spikes are most valuable early in the trade, when time is still on your side

It’s also worth knowing that vega drops as options go further out of the money. That’s great for entry (premiums are cheaper), but once you’re in the trade, low vega means you won’t get much help from an IV spike unless the price moves closer to your strikes.

.png)

Long Strangle vs Short Strangle

The long strangle is a long volatility trade. You’re betting the stock makes a big move beyond one of the strike prices. The short strangle is therefore the opposite of this trade, a market-neutral trade with room to breathe.

- Short strangle: Sell an out of the money call and an out of the money put. Limited reward, significant risk, but high probability of profit if the stock stays put.

- Long strangle: Buy an out of the money call and put. Low probability, high reward: you're hoping for a big move in either direction.

Long Straddle vs Long Strangle

The long straddle and strangle have a lot in common, but also have some key differences:

.png)

- Straddle: Higher cost, higher sensitivity. Best if you expect a massive move and want max exposure to IV and price action.

- Strangle: Cheaper entry, but lower odds. You’ll need a bigger move just to break even.

3 Risks of Long Strangles

1. Time decay

You’re long options, so theta works against you every day. If the move doesn’t happen fast, your premium melts away.

2. The move comes too late

A big move in the final days might not recover the premium. Late-stage gamma can help, but theta is usually in complete control by then.

3. Liquidity risk

Options on thinly traded stocks or ETFs can have extremely thin markets. Signs of low liquidity include:

- Wide bid/ask spreads

- Low open interest

- Low volume

If you're trading illiquid strikes, you will likely have issues getting filled at a decent price, particularly when volatility jumps. Read more about option liquidity in our dedicated article.

Long Strangles and The Greeks

In options trading, the Greeks are a series of risk tools that hint at the future price of an option based on changes in different variables. Here are the 5 most important Greeks to know:

- Delta – Measures how much the option price moves relative to the underlying stock.

- Gamma – Tracks how Delta changes as the stock moves.

- Theta – Measures time decay, showing how much value the option loses daily.

- Vega – Sensitivity to implied volatility, affecting option price.

- Rho – Measures impact of interest rate changes on the option price.

And here is the relationship between long strangles and these Greeks:

⚠️ Long strangles are expensive, high-risk trades. While your max loss is capped at the premium paid, that premium isn’t cheap, and time decay works against you every day. This strategy isn’t for everyone. Commissions and fees are not reflected in the examples above. Always read The Characteristics and Risks of Standardized Options before trading.

FAQ

Both are neutral, long volatility trades. A straddle buys the call and put at the same strike, while a strangle uses different strikes, making it cheaper, but requires a bigger move to win.

You manage long strangles by watching implied volatility and price movement. If the stock moves or IV rises, take profits. Time decay speeds up near expiration, so get out before then.

Not usually. You are buying two out of the money options that both lose value over time. If the stock does not move enough, the trade loses money.

A short strangle involves selling an out of the money call and put with the same expiration. You make money if the stock stays between the strikes.

Time decay is the main risk of the long strangle. If the stock stays flat, both options lose value every day. You can lose everything you paid.

A 20 delta strangle uses a call and put with about 20 delta each. Added together, this implies the trade has a 40% chance of expiring in the money.